How travel insurers ANWB, Rabobank, and Univé make compelling offers

The vacation season is here! A regular ritual for many vacation-goers is shopping around for new travel insurance. There are many factors to consider: should it be a short-term or annual plan? What is (and is not) covered? And how can I get a discount? Spending time on securing the best deal is important for consumers because they want to know they have the right coverage when they suddenly need it. WUA researched how insurers ANWB, Rabobank and Univé present their travel insurance offers. Read their best practices below!

In February, WUA carried out a half-yearly online orientation study for travel insurance, with a panel of 400 typical customers. Using both computers and smartphones, consumers searched for a new travel insurance provider. They viewed multiple websites and then completed a survey that reviewed their experience on each one. Findability, first impression, and user-friendliness were all objectively compared across multiple providers.

These are the best practices that ANWB, Rabobank, and Univé apply to their offers for travel insurance on the landing-page and calculation page (in which the customized policy cost is calculated).

Best practice #1: Send consumers to the right product

On the ANWB landing page, visitors immediately see a ‘Help to choose’ tool that guides them to the policy they want. Using drop-down menus they can determine a best-match policy based on the number of people, how many days, and which coverage they want to buy. Using a calculation tool, the results of their selection are shown, including the associated costs.

Respondents value the convenient way they can get an immediate price indication:

- “Immediate overview of costs, the two important options are made clear.”

- “Clear website, and immediately you can use the calculator tool to find the right insurance.”

- “The costs are indicated immediately. Clear drop-down menus for making a personal choice.”

Also read the report: Winning tactics from retail leaders, featuring best practices from Coolblue, The North Face, bol.com and KPN.

Best practice #2: Give an immediate overview and clarity

Next, the ANWB landing page shows a clear distinction between what is and is not covered by the insurance. This helps guide users to the right information. With the in-page navigation consumers can search for the right information. The dark blue CTAs stand out and visually direct consumers’ attention towards them. The use of borders and contrasting color between the background and the information creates an easy to understand overview.

color between the background and the information creates an easy to understand overview.

In this way, respondents are clearly presented with all the essential information:

- “You can see what is and isn’t covered by the basic policy, and it explains additional coverage.”

- “User-friendly, you immediately see what you need to do, well-structured.”

Best practice #3: Create trust with expertise and competence

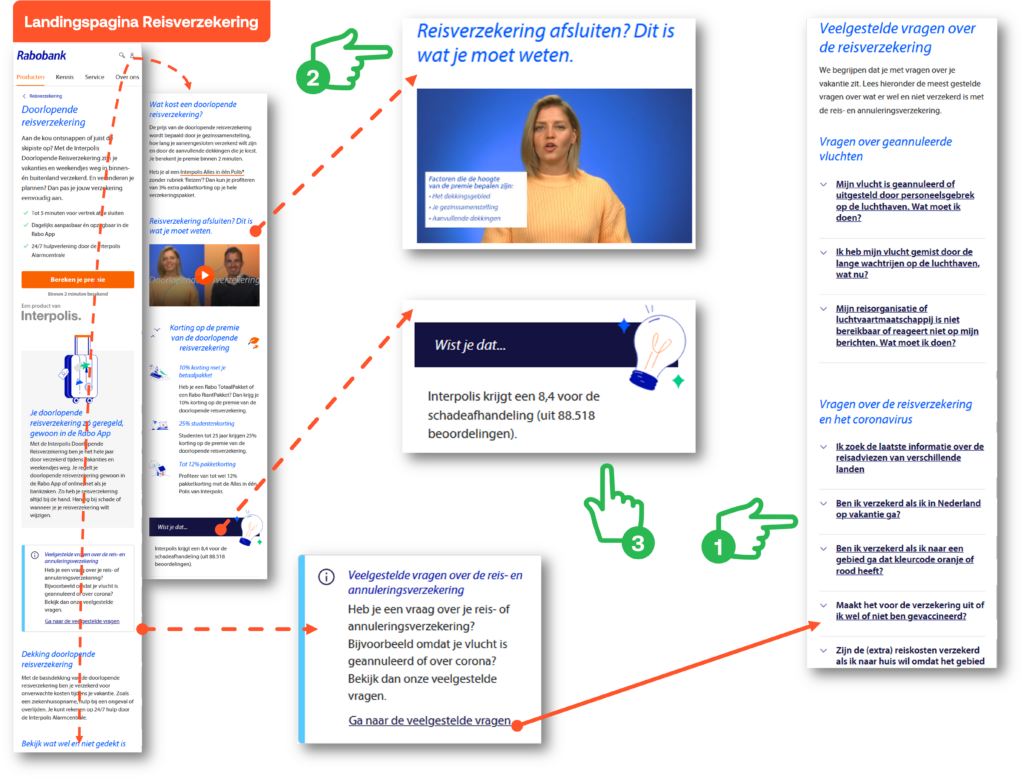

The Rabobank landing page answers the majority of consumers’ most common questions, and this lets them show off their knowledge. The short explanatory video informs consumers about what they need to know about choosing a travel insurance policy, and this radiates expertise. With customer reviews, Rabobank communicates their competency.

This way, respondents felt fully informed:

- “Nice, easy to understand video, shows all the steps required to take out an insurance policy.”

- “All the required information is available.”

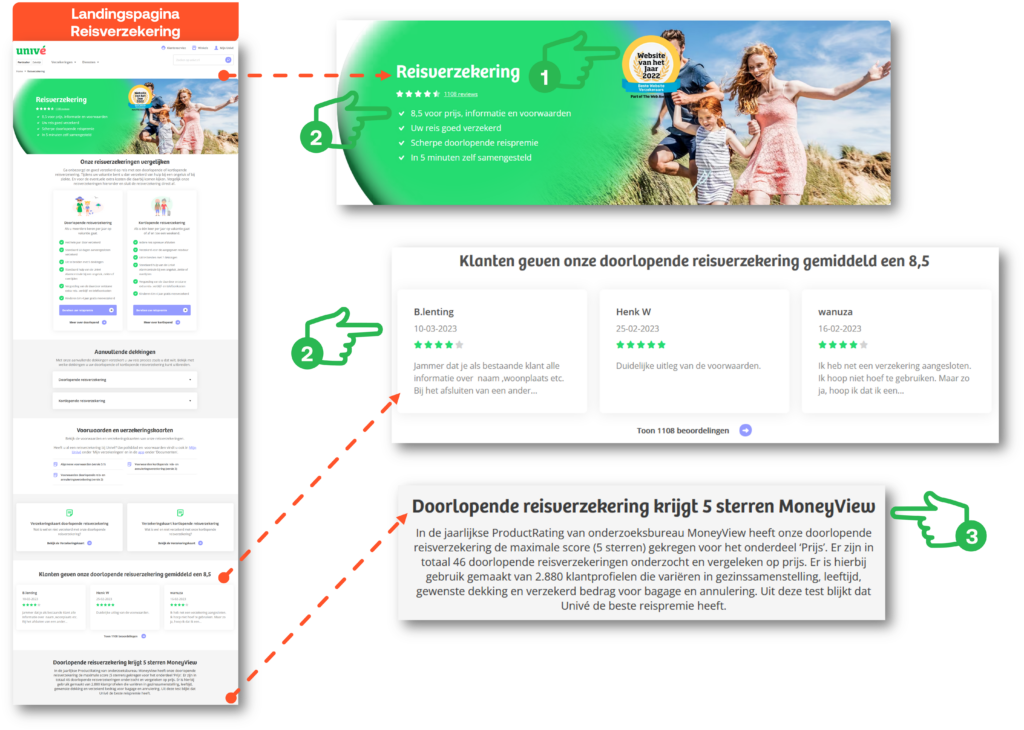

Best practice #4: Stand out with social proof

Univé pays extra attention to social proof with a badge, reviews, and statistics. The ‘website of the year’ seal/badge is prominently displayed on the screen and is immediately visible above the fold. In both the header and further on in the page, the consumer is persuaded by customer reviews. This allows Univé to show what customers are saying about their travel insurance and it’s possible to see all the reviews – giving a clear impression of transparency and honesty. With the addition of a rating from an independent research organization, MoneyView, their power of persuasion is further multiplied. There is a strong message throughout that Univé has the best premiums in the business.

Respondents are sensitive to social proof:

- “They distinguish themselves with the high review scores that they get.”

- “Shows website of the year, checklists are nice. Displaying the amount of positive reviews is great.”

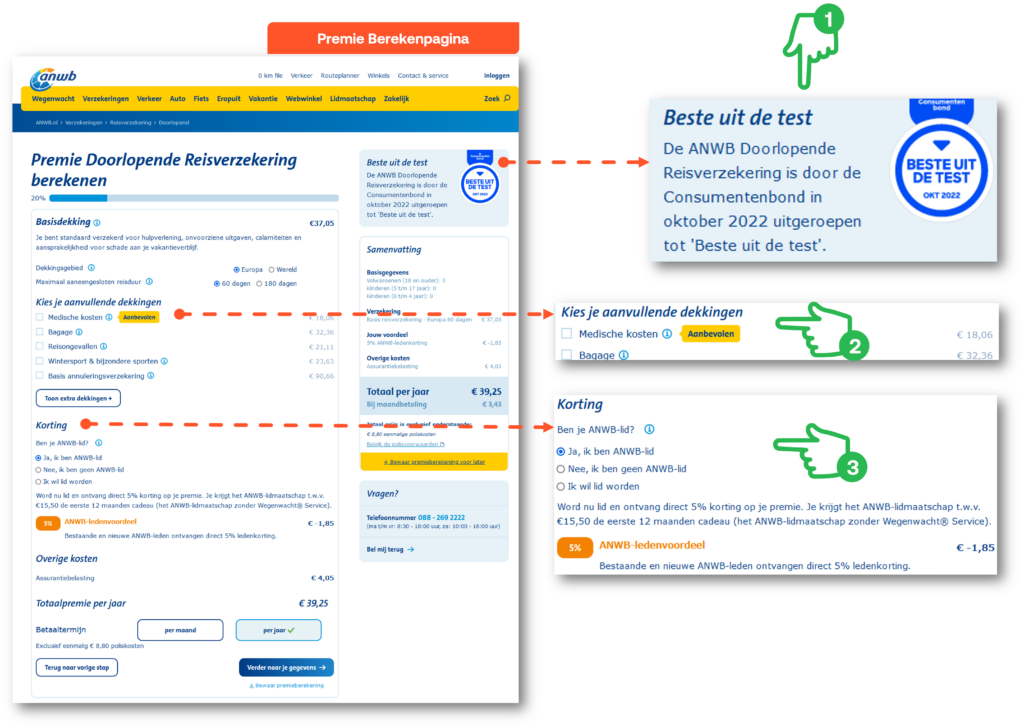

Best practice #5: Persuade the consumer to take action

The ANWB calculation page includes various elements that help persuade the consumer to take action. The award from the Consumentenbond (a trusted consumer advocacy organization) shows that their annual policy is the ‘best out of the test’, and makes it clear why this is the most frequently chosen policy. The ‘recommended’ label persuades the consumer to select additional coverage for medical costs. ANWB members get a member discount which has a positive effect on the price perception and convinces new customers to become members of the ANWB.

Respondents give the ANWB serious consideration:

- “With 3 simple buttons you put together the desired package, and see immediately how this affects the price. Also, nice to see that it has an award from the Consumentenbond.”

- “Additionally, you get an extra 10% discount for the first year when you select an annual policy.”

In short: best practices for offering travel insurance

As a provider of any service or product, it’s important to win over the consumer. These are the five best practices to always keep in mind:

Help to choose: Direct consumers straight to the right product. Use a ‘help to choose’ tool, drop-down menus, and a calculator tool to answer consumers’ questions quickly.

Clarity: Show a clear distinction between what’s covered and what isn’t – just like ANWB does. With the in-page navigation, prominent CTAs, use of borders and contrasting colors, you can create a clear overview.

Trust: Just like Rabobank, show off your in-house knowledge by answering most of their most common questions. An explanatory video quickly informs consumers and radiates expertise. By showing reviews, you show your competency.

Social proof: Let others tell them how good your services are. Univé does this with the ‘website of the year’ badge, customer reviews, and the rating from MoneyView.

Stimulate action: Persuade the consumer with elements like an award from the Consumentenbond and a ‘recommended’ label. The ANWB offers an extra discount for members, which improves price perception.

Following these best practices can have immediate positive effects on the customer experience. But, to stay at the top of your game, you need to keep working on providing the optimal experiences for customers. This is a continuous process that keeps you ahead of the competition at every turn. Learn how WUA can help you achieve the best CX in your sector, and start winning a bigger share of the market.

Curious about more best practices?

Download the free report "Winning Tactics from Market Leaders in Retail" featuring best practices from Coolblue, The North Face, bol.com and KPN.