The demand for attention: how BBVA makes sure consumers get the right information in seconds

The digital landscape is getting more important by the day, and the pandemic has dramatically accelerated that process. Optimizing the digital customer experience (CX) is essential for keeping the attention of the customer.

Convenience and quickly obtaining the correct information have always been factors in choosing a product or service. However, in the current world where websites are competing for attention, there is always a narrow balance between giving too little, just enough or too much information.

Grabbing attention with a winning digital customer experience

Attention has gotten more scarce, options are numerous, and just a click away. Your digital customer experience needs to offer the right information without being overwhelming. How can you make sure your potential customer receives the right information within a few seconds, preventing them from bouncing because of too much (or too little) information?

With financial products, this information balance is even more critical. Consumers want to have an excellent and trustworthy product when taking out a personal loan but do not spend hours searching for all the necessary information. A smooth digital customer experience should clearly offer the information needed to answer the question they have right now.

What are the rates? What minimum and maximum amount is there? What are the requirements to apply? How does this loan fit my personal needs? In 2022 these are all questions that need to be answered within seconds before the attention span of the potential customer is depleted.

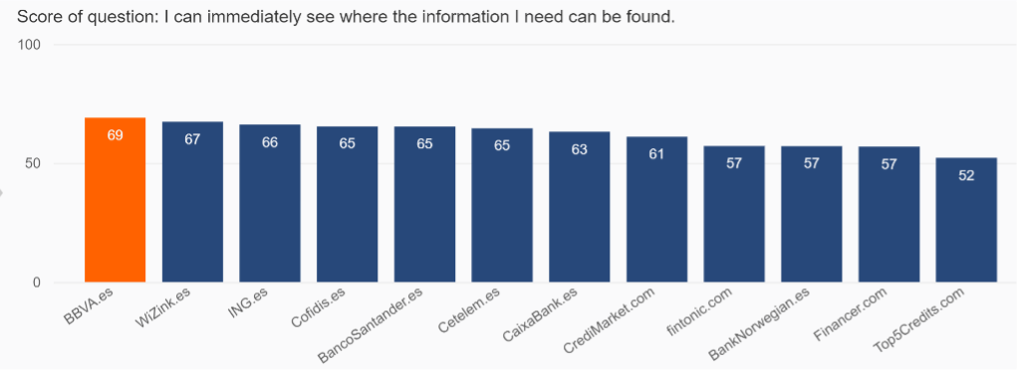

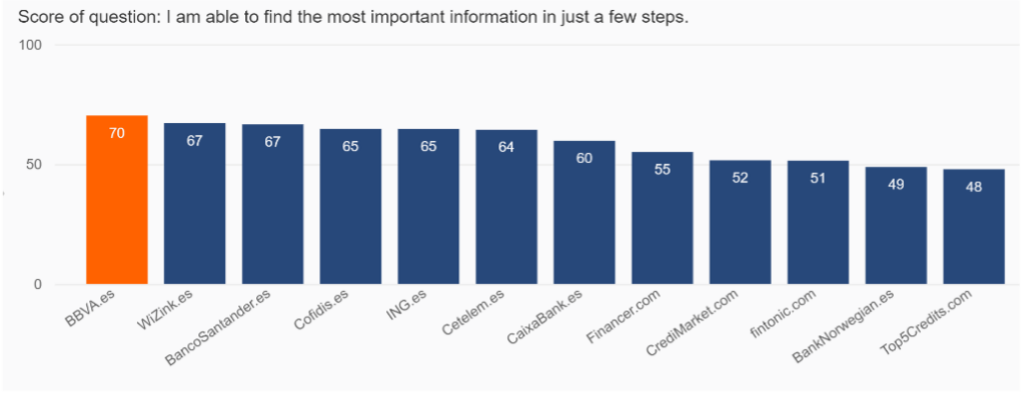

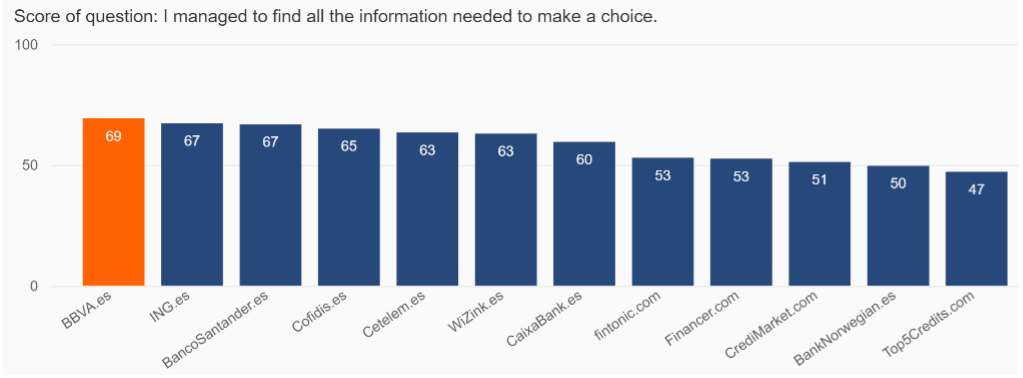

In the January/February 2022 Personal Loan Study in Spain, BBVA scored best on all information metrics for their digital CX and is the biggest winner overall. What information does the potential customer want before choosing where to apply for a personal loan, and how quickly do they want it? The WUA dashboard gives insight into these and more questions.

An optimized digital CX: Covering the essential information without overwhelming the visitor

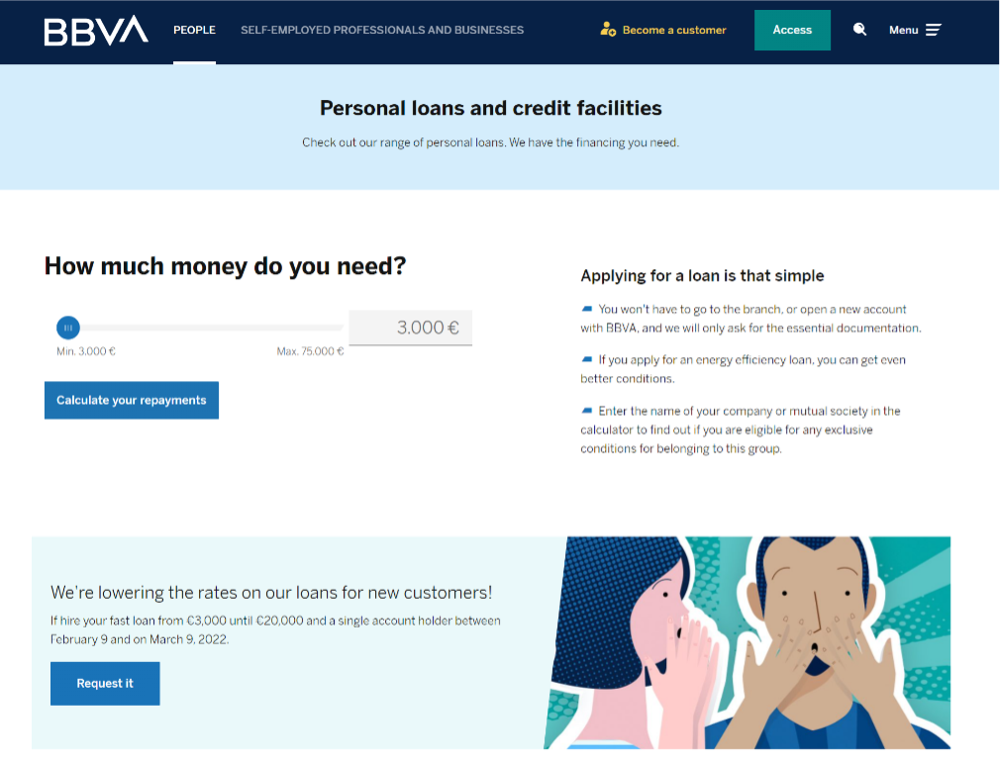

- “How much money do you need?”

The Quick-and-dirty calculator tool allows the visitor to cut right to the chase if that is what is required. Direct feedback in an easy way: drag the slider to the needed amount and click the button. - “Applying for a loan is that simple”

BBVA is aware of the importance of a quick and easy solution to the problem of the consumer. There is no need to go to the branch or open a new account, only the essential documentation, and you are good to go. - “We’re lowering the rates on our loan for new customers”

Not only can you apply very quickly, but you will also get an excellent deal if you apply now. What are you waiting for?

An personalized digital customer experience: From ‘Quick-and-dirty’ to ‘Personal-and-cleanly’

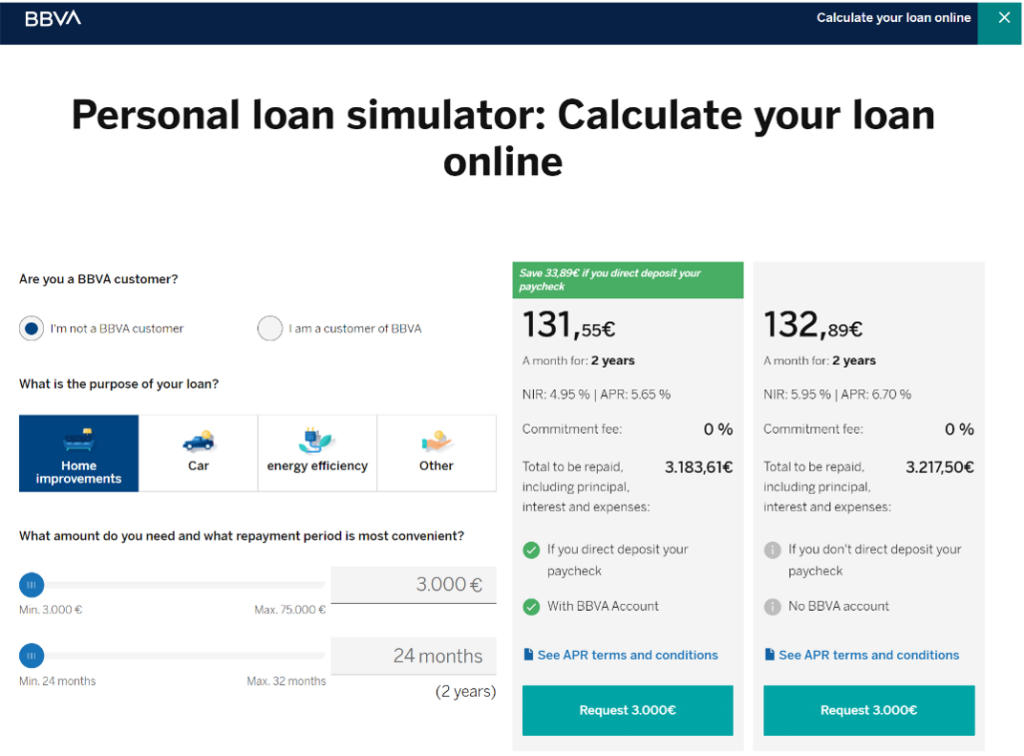

The ease with which the quick-and-dirty calculator is used greatly enhances the chance of drawing potential consumers further into the funnel. An optimized digital CX will reflect the needs their specific customer journey, and give a personalized feel. One quick drag of the slider and click of the button leads the visitor to a more advanced calculator that gives a personalized touch to apply for a loan.

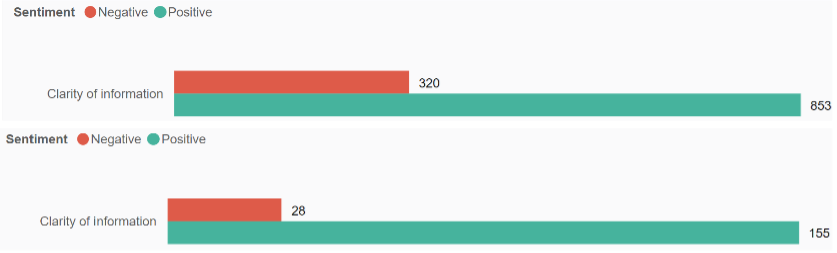

Overall in the Spanish market, 38% of the qualitative answers concerning the clarity of information are negative. For BBVA, only 18% of all comments have a negative connotation (WUA Dashboard Data)

-

“The loan can be fully simulated on the same page.”

-

“There is a quota simulator just by entering the page, which makes it quite quick and easy to find the information.”

-

“They are meticulous when it comes to giving all the necessary details to apply for a loan.”

-

“The colors and the design of the calculator is straightforward and clear”

Additional information

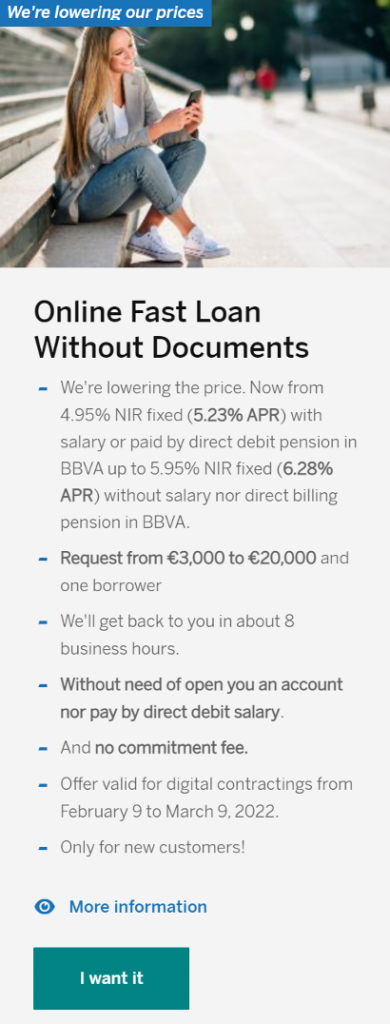

Before diving into the loan specifics, potential customers might need some additional information by calculating a premium.

If this customer is not served, they tend to feel pushed into applying for a loan and are more likely to leave the website to browse a competitor. BBVA solves this problem by informing on the most important characteristics of a loan at BBVA:

a) Lower rates + specifics

b) Loan margins: 3.000 to 20.000 euros

c) Quick response times

d) No need to open an account

Still not enough information to make a calculation? BBVA directly links to a page where all the information is extensively reviewed and explained. Enough information to make a calculation? Go right ahead!

“Everything is very well explained also; the page is extensive and has all the necessary information.”

“It is easy and very clear. Information is easy to understand and find”

“All the information appears in a very schematic and clear way to have all the details.”