Simplicity takes the stress out of getting personal loans

SAN FRANCISCO – Insights from the November 2017 Personal Loan Digital Experience Benchmark

When it comes to getting a personal loan in the U.S, there are plenty of lenders who are more than happy to give one. From traditional banks such as Wells Fargo to loan-specific companies like LendingTree, customers are spoiled for choice. Considering how competitive the loan market is, what makes someone in need of cash in advance choose one lender over the other?

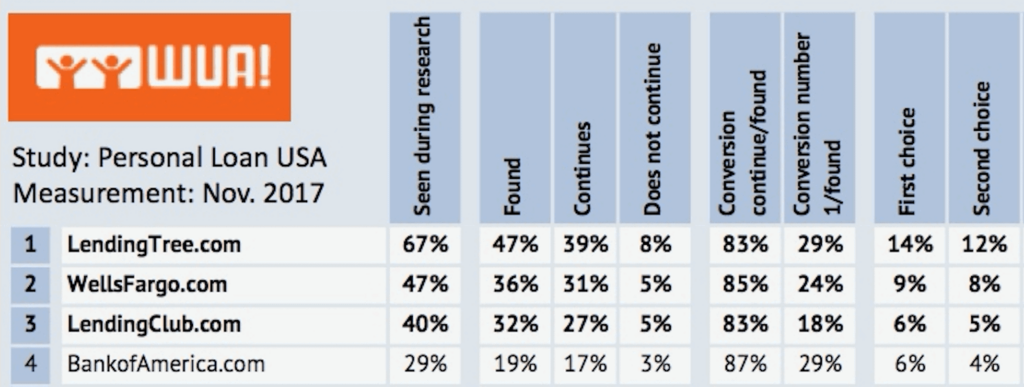

High level results from the Personal Loan Digital Experience benchmark. See the full results here.

In this Digital Sales Scan, WUA searched for the best online practices that allow lenders to distinguish themselves from the rest of the competition. Respondents in this study were told to go online and take out a personal loan of approximately $10,000 that best suits their needs. The study produced a number of insights into how lenders can give their customers a better, more well-rounded online experience.

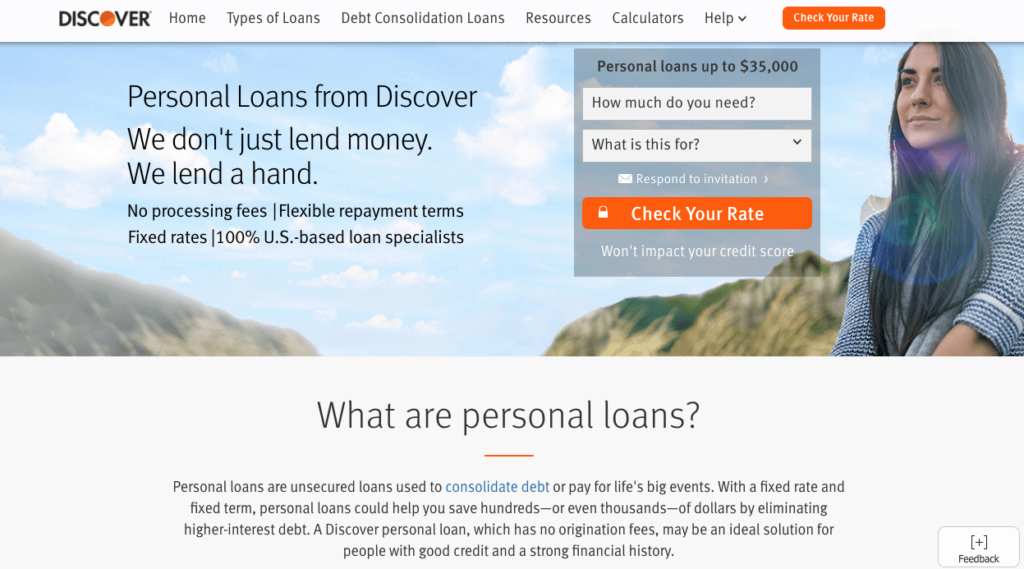

Discover takes the stress out of getting a personal loan

Getting a loan entails borrowing thousands of dollars with interest on top of it. Just the idea of applying for one and owing so much money sounds stressful, so lenders need to make the whole process seem as simple as possible. This is exactly what Discover does well. In the category ‘website uses clear language,’ respondents awarded Discover with the highest score by far.

Discover makes taking out a loan seem like the obvious thing to do. The heading found in the middle of the page asks the simple question “What are personal loans?” and follows it with a simple answer that also reveals its benefits. Discover’s approach impressed our respondents, with one lauding the page for “looking clear and crisp.” The use of clear language may also explain why Discover was tied best for usefulness when looking for a personal loan.

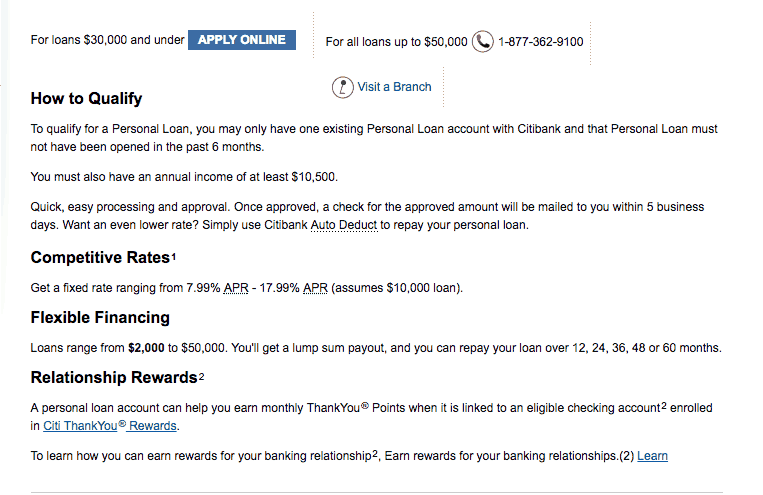

Respondents like the flexibility of Citi’s personal loan offer

Before anyone is going to dive into the application process, they need to know the details that come with getting a personal loan. Citi Bank provides a straightforward account of what customers should expect, provides a variety of different offers to choose from, and allows for an adjustable repayment period that ranges from 12 to 60 months. Respondents applauded Citi for having “lots of options” and “low interest rates,” giving the bank the highest rating for product offer.

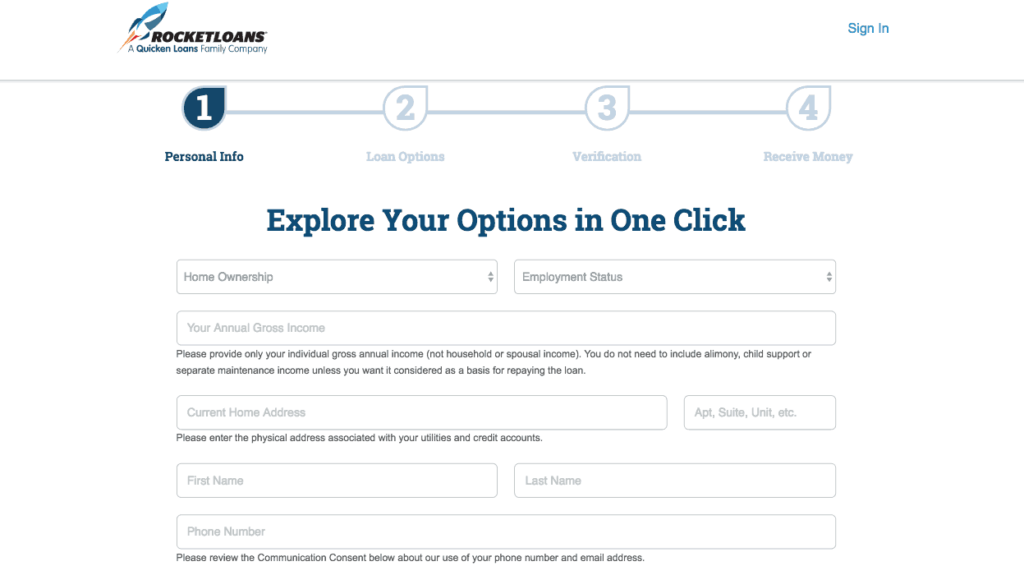

QuickenLoans gives customers a preview of how easy it is to apply for a loan

Let’s be honest: No one is ever in the mood to spend a lot of time filling out an application form. QuickenLoans knows that, which is why they make the application process on their personal loans affiliate website RocketLoans seem as quick and easy as possible. One way they do that is by placing a graphic that displays the four easy steps for getting a loan, with the last one being ‘Receive Money.’

It’s no wonder QuickenLoans stands atop the rankings for providing a ‘smooth’ and ‘easy’ application process. After filling some basic information, all a customer needs to do is choose the loan option they want and verify their account. The webpage keeps it simple, avoiding the use of pop-ups, graphics, or any unnecessary information.

WUA’s Digital Sales Scan

The results of our Digital Sales Scan revealed how essential it is for lenders to keep the entire process of getting a loan simple. Still, while simplicity is key, there are a number of different details our data tells us that can work to boost the digital sales of lenders. WUA independently measures the customer journey of online markets to discover who provides the best online customer experience and the best practices across industries. Based on this data, WUA’s digital experts can create a custom-tailored report for your website to improve the customer journey step-by-step.

Each Digital Sales Scan report includes market best practices both inside and outside your industry, recommendations and customer feedback on each step of the customer journey, and screenshot analysis to help your team create a better website and drive conversion. Read more about the Digital Sales Scan here.