WUA’s newest Personal Loan study: Insight in the journey of 600 potential customers

SAN FRANCISCO – According to PWC (home) borrowers value lenders that combine digital tools with knowledgeable advisors. Customers want to be able to talk with someone knowledgeable to address their concerns but want to research and apply for a loan online. In other words: make sure that your website caters to your customers’ needs is now more important than ever. In our newest research, we’ll research how many customers find your website (findability), how customers compare your website to the competition, and how many customers think your website is the best in the market (conversion).

Task in our newest research

The 600 respondents in this study were given the following task: “Imagine that you want to take out an unsecured personal loan of approximately $10,000, to pay off Credit Card (or other) debt, to finance a home improvement project or other big purchase. Note that this is different from a mortgage or car loan. Go online and search for different unsecured personal loans to find options that best suit your needs.” Each respondent featured in this study searched for a personal loan via smartphone or desktop. For the full research set up, download last year’s insight report.

Download last years Personal Loan Study (November 2017)

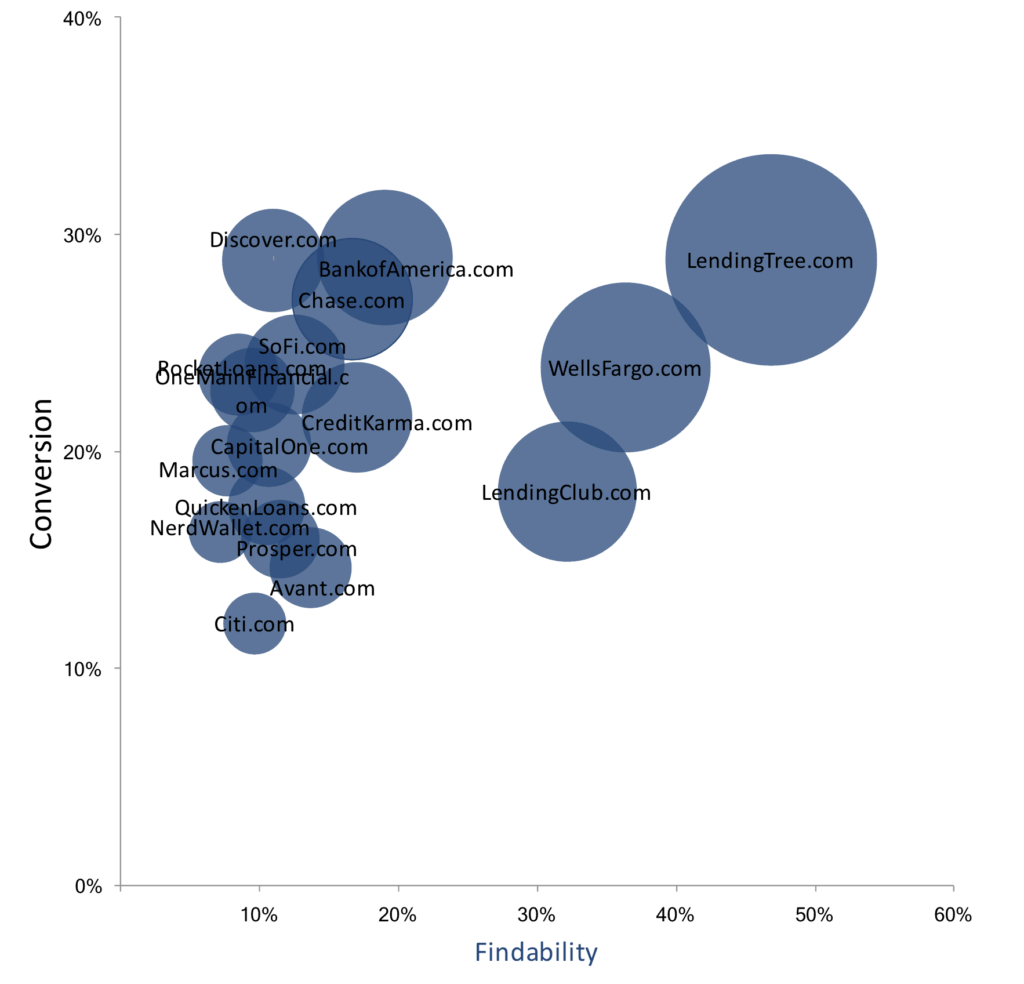

Personal Loan study 2017 led by LendingTree

In 2017 the Personal Loan market was led by LendingTree.com. With a 14% preference and Digital Sales Score of 65 (6pt. lead over Wells Fargo), they ranked first. What’s interesting is the difference in findability with WellsFargo.com, where LendingTree.com was found by 47% of the respondents, runner-up WellsFargo.com has a findability of 36%. A high findability isn’t a good indicator of conversion though. BankofAmerica.com (4th in our study) and Discover.com (#10) are found by fewer people but have a conversion of 29%, just as LendingTree.com.

To beat the competition, you have to offer an excellent digital experience

This study will once again that Digital Excellence is an absolute necessity. To beat the competition, you have to offer an excellent digital experience in the entire customer journey, and take the number 1 position when it comes to preference. Being found and scoring high in Google isn’t enough. You have to design a website that guides the customer to the product they want and provides a feeling of support. Would you like more insights into the US market for a personal loan? We will have a crystal-clear image of your position and results. Download the results below to learn more.

-

Know where you stand relative to consumer-expectations and experience that others in the market

-

Know your major improvements and highest priorities for conversion optimization

-

Learn from best practices within and outside your industry and learn from the best